Voluntary Carbon Market

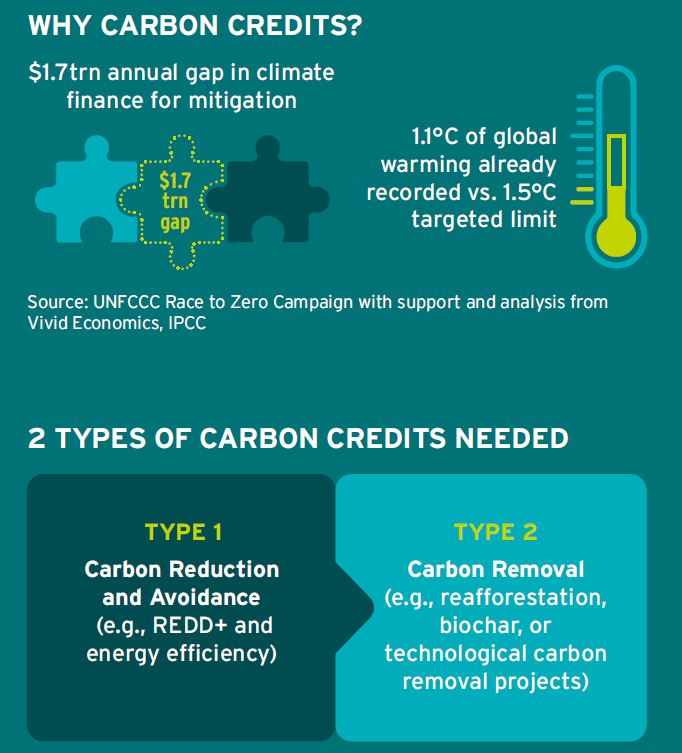

There is currently a $1.7 trillion investment gap in climate mitigation that needs to be closed to limit the negative impact of climate change on both people and the plant. As the public sector does not have the fiscal capacity to reach this investment figure alone, 70% of all climate finance needed must come from the private sector. For these reasons, we must deploy all available financial tools, while at the same time develop new, innovative financial tools that can be scaled up rapidly. Remember, we are in a race against time; we need to reduce emissions by 45% from 1990 levels by 2030 to have any chance of limiting temperature increase to a 1.5ºC rise. 2030 is only seven years away and we are currently not close to these targets.

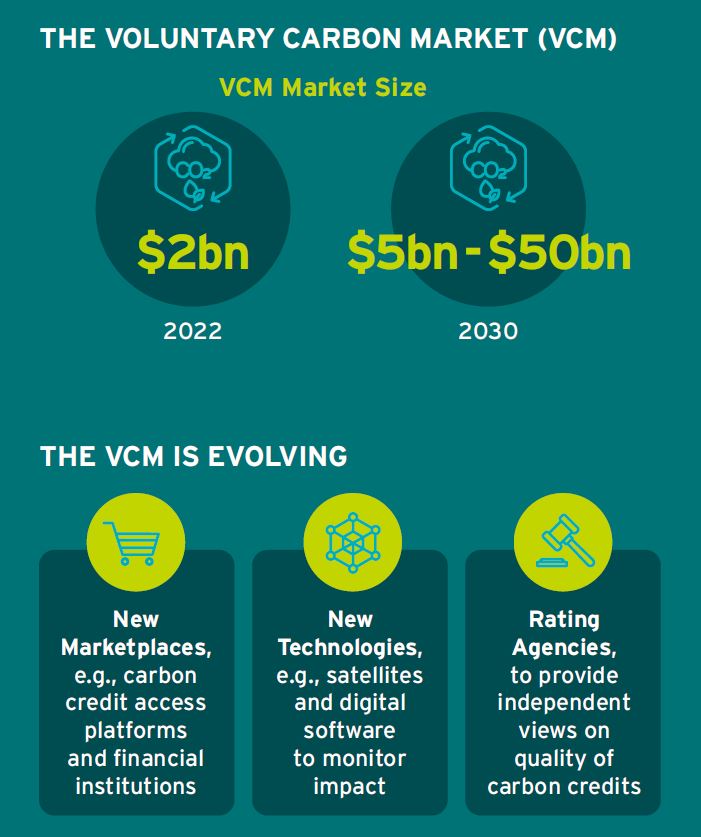

The voluntary carbon market (VCM), although nascent, has managed to provide financing for many sustainable projects in developing and emerging countries. Traditionally, these countries have a hard time attracting private investment due to factors including the perception of risk, lack of bankable projects, foreign exchange, and high debt levels. The VCM is currently valued at approximately $2 billion, but many project it will scale up significantly over the next decade as more companies invest in voluntary carbon credits to reduce their residual emissions.

The VCM has come under scrutiny by the media, causing many buyers to question this market due to reputation worries. However, this market is needed. It is very difficult for companies, especially those in hard-to-abate sectors to reach net zero without investing in carbon credits. Collectively, these sectors (steel, cement, aviation, shipping, and road freight) account for 25% of today’s global carbon emissions but have the potential to rise by 50% through 2050 given growth expectations. (See Citi GPS, Hard to Abate Sectors and Emissions; The Toughest Nuts to Crack for a Net Zero Future.) Hard-to-abate sectors typically have long-lived capital assets, such as industrial plants, which are expensive and difficult to change. They also require new fuels and technologies that are currently not available on a large commercial scale and are not yet economically feasible.

Hard-to-abate sectors are not the only ones requiring carbon credits. In the limited time available, it is inherently difficult to reach net zero across many sectors, especially regarding scope 3 emissions. Companies still need to reduce their emissions and invest in low-carbon solutions — both investors and the general public demand that this occurs and many companies are working hard to achieve this. It is also inherently difficult to raise the capital needed in emerging and developing economies for them to move to a sustainable economy.

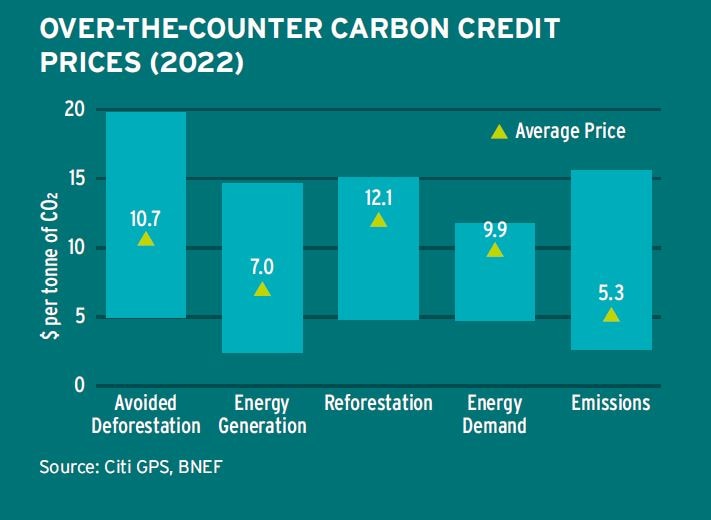

We cannot deny the market currently has some problems. These include transparency in the pricing of credits, confusion among buyers as to how the market works, and confusion on ensuring that what they are investing in actually reduces, avoids, or removes carbon emissions

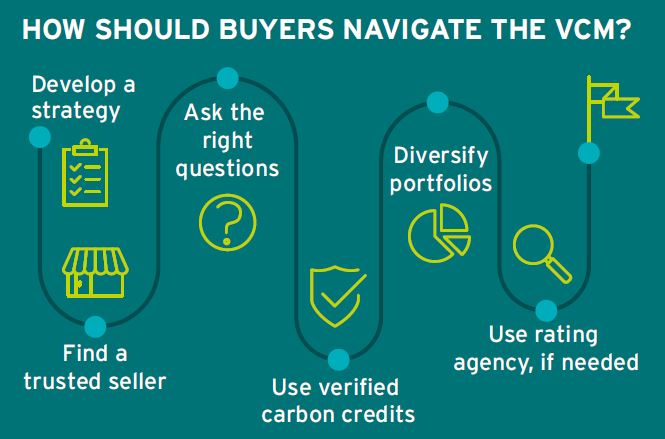

In this report, we provide a guide for companies to help navigate the VCM. We discuss how the market works, describe what initiatives are being done to improve it, and identify six steps that companies can use to help them use it effectively. These include (1) developing a strategy for the use of carbon credits across their business, (2) finding a trusted seller, (3) asking the right questions, (4) ensuring the use of verified carbon credits, (5) diversifying portfolios, and (6) using rating agencies if needed.

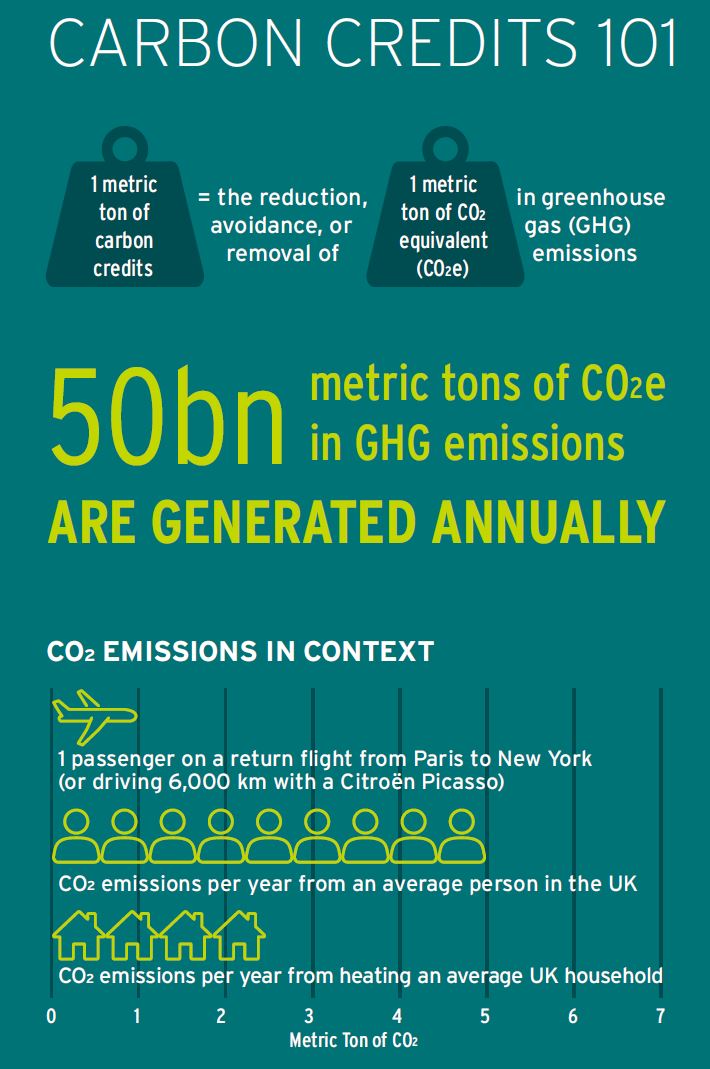

Carbon Credits 101

Why Carbon Credits?

OTC Carbon Credit Prices

The Voluntary Carbon Market

How Should Buyers Navigate the VCM